Posted On: July 12, 2024 by American First Credit Union in: Loans

Navigating the world of auto loans can be confusing, but knowing your options is the first step to making a smart financial decision. In this article, we'll look at two popular choices: the enticing 0% APR offers from dealerships and the often advantageous pre-approval from your local credit union. By comparing the two, we aim to equip you with the knowledge to choose the best financing option for your next vehicle purchase.

What is a 0% APR Auto Loan?

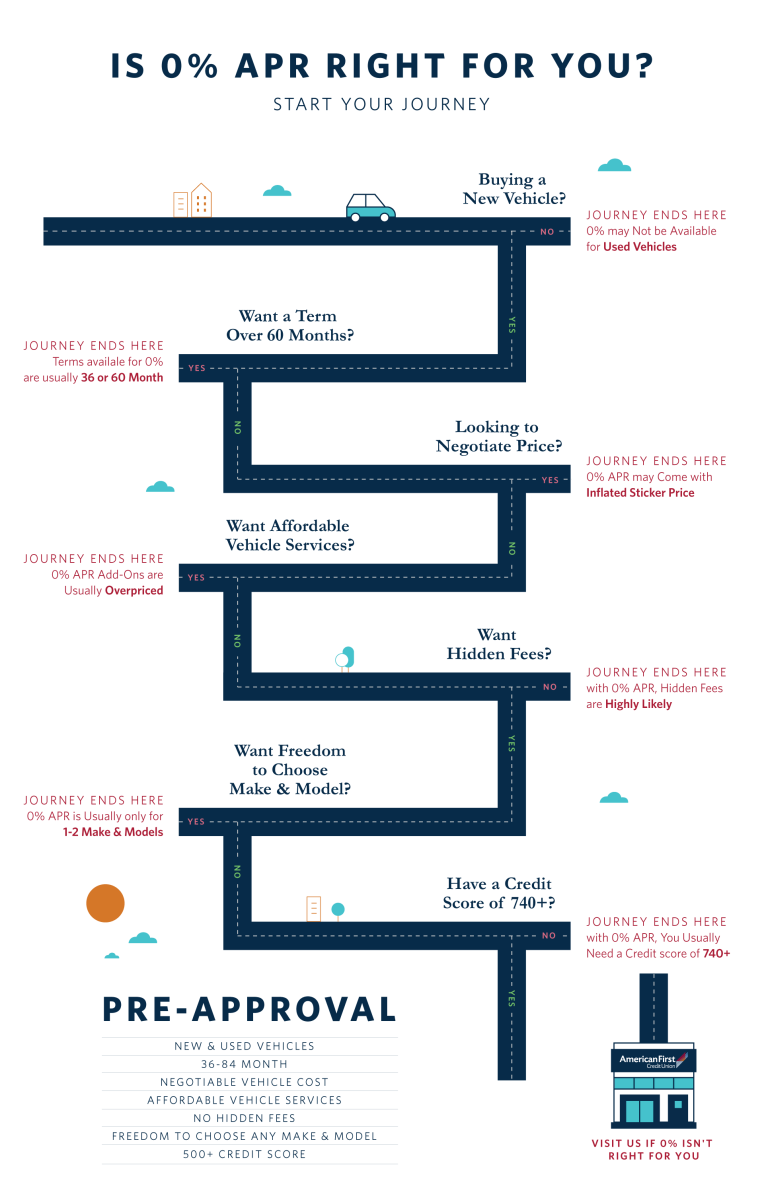

A 0% APR auto loan is a loan on which the borrower pays no interest. APR stands for Annual Percentage Rate, and when that rate is set at 0%, the borrower's monthly payments won't have any interest added on. Sounds great, doesn't it? But here's the catch: 0% APR auto loans, while tempting, are often used by dealerships for their own reasons, which might not benefit you in the long run.

7 Things to Look Out for When Considering a 0% APR Auto Loan

-

Dealerships use the 0% APR offer to lure unprepared car shoppers into their showrooms. Once they get a shopper comfortable with the prospect of driving away in a new vehicle, they'll reveal some of the catches that come with a 0% APR offer or try to upsell the shopper on a different vehicle.

-

0% APR is only offered on specific models that aren't selling as fast as the other popular models. This restricts the shopper's options to only a few models, and dealerships won't offer 0% APR on any used vehicles.

-

Dealers could inflate the vehicle's sticker price and include hidden fees to ensure the dealership still turns a profit. This allows them to cover their costs and maintain their profits even with the interest-free deal, potentially leading to a higher overall cost for the shopper.

-

Rebates and other money-back incentives are likely not included in a 0% APR auto loan. These special incentives are off the table because the dealerships believe 0% APR is a good enough incentive on its own, not able to be coupled with other offers.

-

Strict loan terms. It is highly likely that the 0% APR offer the borrower thought would save them money can result in higher monthly payments. This is due to shorter loan terms that the dealership won't negotiate.

-

Sneaky fine print. Some dealerships can include fine print that makes the borrower liable to pay interest on the total loan amount if they're late on even one payment. If the dealership doesn't hold you liable for interest on the total loan amount, they could take away the 0% APR and charge you a high-interest rate for the remainder of the loan as a penalty.

-

0% APR auto loans are reserved for "well-qualified" buyers. In most cases, "well-qualified" refers to borrowers with a credit score of 740 or higher. If a borrower isn't in this credit bracket and applies for the 0% APR offer, they could be taking a hit on their credit score that could have been avoided.

What We Recommend

Secure a pre-approval before you shop to put negotiating power back in your hands as you search for your dream vehicle. With pre-approval, you won't be limited to only a few options, and you can get the same great rate for new and used vehicles. If you want to add popular vehicle protection services like Guaranteed Asset Protection and Major Mechanical Protection, see if the lender who pre-approved you offers them. They will likely be much cheaper than the same services sold at the dealership if they are available. When you finance with your credit union, you have more flexibility to choose your terms, which puts you in control of your monthly payments.

If you automatically received a pre-approval offer through mail or email, accepting and using that pre-approval won't negatively impact your credit score. If you want to apply for a pre-approval, we recommend applying to 2 or 3 lenders in a 14-day time frame. When multiple lenders make an inquiry on your credit report quickly, it will only count as one inquiry and lessen the impact on your credit score. From there, you can choose your best offer and go shopping, knowing your financing is already secured.

0% APR or Pre-Approval Side-by-Side Table

0% APR

Pre-Approval

Type of Vehicle

New Vehicles Only

New & Used Vehicles

Terms Available

36 or 60 Month

36-84 Month

Vehicle Cost

Inflated Sticker Price

Negotiable

Vehicle Services (Add-Ons)

Overpriced

Affordable

Hidden Fees

Highly Likely

None

Make & Model Availability

1-2 Make & Models Only

Freedom to Choose Any Make & Model

Credit Score Requirement

740+

500+

If you're interested in getting a pre-approval from American First,

click the button below.

Sources: Ramsey Solutions, Bankrate, Consumer Financial Protection Bureau, Federal Trade Commission Consumer Advice, and RateGenius